The ERTC Experts

Our CPAs and Tax Attorneys are specially trained and uniquely qualified in the complex ERTC program. Our experts only handle these types of claims to ensure that we are able to maximize your refund while remaining in full compliance with IRS rules and guidelines.

The Employee Retention Tax Credit

Maximizing Your Claims For Keeping Americans Employed

The government has authorized unprecedented stimulus, and yet billions of dollars will go unclaimed.

Funded by the CARES Act

No Restrictions - No Repayment

Up to $26,000 Per W-2 Employee

Free Pre-Qualification

Get Employee Retention Credit For:

Revenue Decline

Capacity Restrictions

Supply Chain Disturbances

Travel Restrictions

Commercial Disruption

Group Gathering Limitations

Full & Partial Shutdowns

Customer or Jobsite Shutdowns

Remote Work Orders

Customer or Vendor Restrictions

Why Choose ERTC Express?

No Upfront Cost

We do the accounting work needed to determine your eligibility at no cost. We only get paid if you do.

Compliance Focused

We are extremely focused on IRS compliance for the ERTC in terms of eligibility. We do everything within the guidelines so you are not put at risk.

US-Based Licensed Professionals

All claims are processed by licensed CPAs and receive final review by seasoned Tax Attorneys.

CPA Driven

All files are evaluated by our American CPAs. We do not use automated software or non-CPAs to work on customer files.

* Power of 3 *

3 different CPA teams cross-check your final refund amount before submitting your claim. That's the level of precision and absolute accuracy that we pride ourselves on.

Audit Defense

We do a full blown assessment. That way, if you're ever audited by the IRS, our Sleep Well Guarantee will give you the verified proof needed to protect you and defend your full refund claim.

Lockbox System

We remove the guesswork on whether you will get paid. Any customer who defers payment uses our lockbox system through the largest IRS approved lockbox provider. They handle disbursement of funds to customer and us.

Client Portal

Clients will be given access to our secure client portal where documentation and eligibility information can be submitted on their own time and at their own pace.

Dedicated Specialist

A dedicated specialist is assigned to each business we work with to ensure the claims process goes as smoothly as possible.

Power of 3 + Sleep Well Guarantee =

Recover Your Money Safely!

These are just some of the businesses we’ve helped…..will yours be next?

Click here to view more client case studies

Business Consulting Firm in Newport Beach, California, 19 W-2 Employees;

$44,960 Credit

Presentation Design Agency in Nashville, TN, 19 W-2 Employees;

$162,979 Credit

Restaurant Ownership Group in Florida, 224 W-2 Employees;

$1,120,000 Credit

Restaurant in Houston, Texas, 80 W-2 Employees;

$400,000 Credit

Montessori School in Addison, Illinois, 35 W-2 Employees;

$175,000 Credit

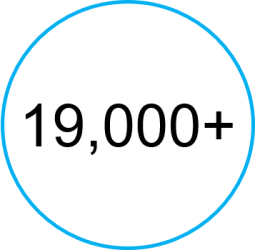

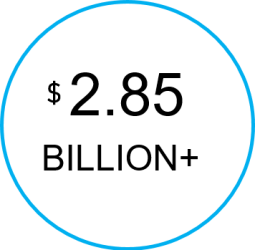

Our Success is Based on Numbers, Not Talk

BUSINESSES HELPED

REFUNDS RECEIVED

Bob K.

BBQ Restaurant, Missouri

C.E.

Church Financial Manager, Virginia

Jack R.

Dental Practice Owner

Michael L.

Multi-location Retail Franchisee, Georgia

Laura W.

Commercial Cleaning Owner

Betsy W.

Transportation Company CFO, California

Toni I.

Restaurant Owner

Justin Weekes

Google Review

RonRa

Google Review

Tia Mia Pizzazz

Google Review

R Romero

Google Review

Michael Witles

Google Review

Eric North

Google Review

HOW DOES THE PROCESS WORK?

* Our quality assurance process is unlike any other in the industry and is handled by our 100% US-based licensed CPAs and Tax Attorneys *

We need you to answer a series of questions and provide a series of documents to verify your answers. This is all done through our secure client portal.

A dedicated CPA will validate all submitted documents to make sure we have everything we need.

Your claim is reviewed by 3 different CPAs who work independently to calculate your total refund. All 3 CPAs must arrive at the same number for your claim to advance to the next step.

We will prepare and help you file the 941-X Amended payroll returns.

The IRS will process your credit and mail you a check.

Estimate & File Your ERTC Claim

Without Paying a Cent Upfront!

Discover how the Employee Retention Tax Credit can help your business. Next, begin the application process below. You’ll receive an immediate refund estimate and the opportunity to file without paying a penny out-of-pocket.

* If you were told that you don't qualify, join the thousands of business

owners that found out otherwise *

FAQs

Most frequent questions and answers

When the CARES Act (Coronavirus Aid, Relief, and Economic Security Act) was signed into law on March 27, 2020, it included two programs to assist businesses with keeping workers employed: 1) the Paycheck Protection Program (PPP) and 2) the lesser-known Employee Retention Tax Credit (ERTC).

Here are the differences:

PPP was administered by the Small Business Administration.

ERTC was administered by the Internal Revenue Service.

PPP funds are based on 2.5 months of payroll. A minimum of 80% of the funds must be used on payroll to be eligible for forgiveness. PPP funds are not taxable as revenue and you may still take deductions for the payroll covered by PPP.

ERTC funds are credits (or refunds) for a percentage of payroll in each quarter for which you qualify. There are very specific rules for determining eligibility by quarter, and the dollars that can be claimed for each employee are limited.

The short answer is YES!

Here’s why: When the CARES Act was originally signed into law on March 27, 2020, employers could choose PPP funds or ERTC credits, but not both. At the time, PPP was more beneficial than ERTC for most businesses, so most businesses with under 500 employees elected to receive the forgivable PPP Loans.

But the rules changed on March 11, 2021 when The American Rescue Plan Act of 2021 was signed into law and included many modifications and expansions to existing elements of previous stimulus programs. (Most people – including CPAs – aren’t aware of this update.)

These changes included:

- Businesses who applied for and received PPP funds can now also claim ERTC credits.

- ERTC credits can be retroactively claimed for businesses that qualified in 2020.

- ERTC credits were extended through 9/30/21 with lower qualification requirements.

- The per-employee cap on qualifying wages increased from $10,000 for all of 2020 to $10,000 per quarter for the first 3 quarters of 2021.

- The refundable credit amount increased from 50% of qualifying wages in 2020 to 70% in 2021.

Unlike the Paycheck Protection Program (PPP), there is no “application process” for the Employee Retention Tax Credits. But there is a process – and you must be compliant.

We are seeing a lot of “pop-up” ERTC companies comparing ERTC to a child tax credit in that they are telling their clients they can claim simply by asserting (or attesting) to the IRS that they can legally claim the credit.

The act of you “attesting” that you are eligible, does not make you eligible! We HIGHLY recommend against this practice. If someone approaches you and asks you to “attest” you are eligible – run, not walk, the other way!

As we mentioned before, ERTC can be a very complex process. We believe it is in your best interest to work with a company who 1) specializes in ERTC, and 2) has your best long-term interest at heart by triple-checking every component of your ERTC filing by our 3 CPA teams to ensure accuracy, compliance, and true eligibility.

Yes, ERTC was originally a 2020 credit.

Like many things from the government, this of course changed several times. The ERTC program truly became valuable to business owners with the American Rescue Act changes in March of 2021. The American Rescue Act changed IRS regulations and allowed millions of businesses who had received the PPP to now possibly receive the ERTC.

You may be eligible. While your revenue may be back to normal, there are additional considerations:

First, even if your revenues have returned to “normal” in 2021, you may have qualified in 2020 and you can retroactively claim those credits. That eligibility criteria in 2020 was based on revenue declines from 2019, and/or if your business was partially or fully closed due to a governmental mandate.

Second, while your revenue may have returned to pre-pandemic levelsin Q1 2021, remember that we are comparing your Q1 2021 to Q1 2019. If 2019 was a year of growth for your business, then your revenue levels 2 years ago may have been much less than Q1 2020.

And lastly, if your revenues were down in Q4 2020 by just 20% compared to Q4 2019, then you may also be eligible for Q1 2021. There is a safe harbor provision that few advisors are talking about, and it means that many businesses are qualifying for $7,000 per employee in Q1 2021.

And beyond revenue, our CPA team will work with you to help identify the government mandates that had a more than nominal impact on your business.

Qualifying for the ERTC program is about much more than simply revenue losses!

This question usually comes from a provision of the CARES Act that allowed employers to defer the deposit and payment of the employer’s share of Social Security taxes. Those deferrals had to be repaid – with at least 50% of the balance due by 12/31/21 and the remaining balance due by 12/31/22.

ERTC credits are NOT a deferral. They are dollar-for-dollar credits against wages you’ve paid. Not taxes you’ve paid, but actual wages. This is an important distinction that people often misunderstand. These credits can offset future tax contributions or you can receive a refund check – it’s your choice. As you would imagine, most people choose to receive a check.

But no. You will NOT have to repay these funds (unless, of course, you don’t provide adequate documentation to support your eligibility). That’s where our team of CPAs can help, by focusing on understanding the specific laws and regulations around this program, and in ensuring every point in the process is 100% compliant.

Your banker, CPA, or Financial Advisor are very familiar with working with the SBA. This is part of why they were very helpful in helping with your PPP funds. Plus, and you may not know this, but the SBA paid the bank administrative fees based on the PPP loans they made, and in this way they were incentivized to educate you about the program and get all your paperwork in order.

The PPP program was also a rather simple calculation. 2 ½ times your average monthly payroll including health insurance and state unemployment taxes. Done.

Contrast that with the complexities of the ERTC program administered by the Internal Revenue Service. From the conversations we’ve had with bankers, they have no interest in involving themselves in your employment tax compliance. For them, not only is it beyond their scope of services, it is a liability.

Plus, if your CPA did know about the program and advised that you were ineligible, it is likely because they were looking at it from a revenue perspective versus limited commerce. These are very important distinctions to keep in mind, because the difference in our ability to handle these complex cases has resulted in many thousands of dollars for clients whose CPA told them they were ineligible.

Computing your ERTC credits requires visibility into your P&L and PPP forgiveness applications. These aren’t documents your payroll service provider will have access to.

Not only that, but the complex requirements around eligibility, compliance, and allocating ERTC credits at the employee-level while accounting for annual and quarterly qualifying wage gaps is far outside the scope of a payroll service provider.

Now, we have worked with some payroll service providers and the ones we’ve worked with so far are happy to provide the payroll registers that we need and they are usually happy to file the Amended Form 941-X with the IRS on our client’s behalf. But that’s it.

Many payroll services are asking clients to sign an indemnification waiver before submitting a Form 941-X because they cannot take responsibility for the accuracy of the ERTC credits you are claiming – it is a liability and beyond their scope of services.

You can read the Notice 2021-20 on the official IRS FAQ Site: https://www.irs.gov/pub/irs-drop/n-21-23.pdf

Your tax accountant is a CPA or EA, and he or she likely only prepares your Federal and State Income Tax Returns. Some accountants also provide bookkeeping services, and others payroll.

We have seen that the majority of CPAs and Accountants do not handle Employee Retention Tax Credit work because of the complex and tedious process to accurately calculate. In October 2022, we taught a session at the American Institute of Certified Public Accountants (AICPA). Some of the feedback we received from other CPAs was – “our main focus is on staying up-to-date on the ever-evolving income tax code, and now can’t become experts in the ERTC program as well.”

The ERTC credits are claimed against Employment Taxes on Form 941, and this is outside the scope of knowledge of most CPAs or EAs.

The reason most people believe they do not qualify is because of the complexity of the ERTC program. If your tax accountant is comfortable determining your eligibility by quarter and year, computing your credits, and preparing the complex documentation to support an IRS audit, then you should certainly let them handle all of this.

If you want a second set of eyes from someone who specializes in complex ERTC filings, we’re happy to help.

Your Bookkeeper should definitely have access to all the information necessary for an accurate calculation. They will have your financial reports, payroll registers, and PPP loan forgiveness documents (if applicable).

The BIG QUESTION is . . . do they have the time? And will it be compliant?

- Do they have the time to dig into the text of the American Rescue Plan Act of 2021?

- Do they have the time to dig into the referenced laws like: CARES Act, Families First Act, Payroll & Healthcare Enhancement Act, PPP Payroll Flexibility Act and the Consolidated Appropriations Act?

- Do they have the time to read the IRS Interpretations and FAQ’s? And cross-reference those definitions with that of PPP which was separately defined and dissimilarly interpreted in the Small Business Administration’s Bulletins and IFRs?

- Do they have the time to ensure accuracy in eligibility determination, maximize your computation and create the supporting documentation you’ll need to support an IRS audit of employer taxes?

We have not found a single bookkeeper who can take all this on, while also handling the day-to-day of bookkeeping.

But, if you want to ensure maximum eligibility and (more importantly) compliance, we’re happy to take a second look.

Revenue is one of many factors that determine whether you qualify for ERTC. In fact, companies without a considerable revenue decline can still qualify for the Employee Retention Tax Credit.

While licensed to do so, this would require your CPA to familiarize themselves with tens of thousands of pages of new tax code to fully qualify your business for the maximum refund per quarter.

For example, we work with many car dealerships that experienced 400%+ increases in revenue during the pandemic but were told by their CPAs that they do not qualify. However, due to the way COVID-19 impacted their business, our team was still able to recover hundreds of thousands of dollars for them through the ERTC program.

We work exclusively on ERTC. It’s what we specialize in. You won’t find us preparing income taxes, compiling financial statements, or providing attestation services of any kind. Our entire business is centered on maximizing your credit.

We have helped thousands of businesses in the same situation. We do not charge a cent to determine your eligibility. We are specialists. ERTC is all we do – assessment, preparation, and filings. If there is money owed to you – our expert CPAs and Tax Attorneys will recover it for you. If not, you pay nothing.

Our team of expert CPAs and Tax Attorneys has successfully filed over 19,000 ERTC claims with the IRS. While a traditional CPA can typically handle filing for a decline in revenue, our attorneys are able to increase your refund total by qualifying you under many of the other conditions outlined within the law.

We don’t get paid until you do, and we do not charge any processing fees to determine your eligibility. You are not required to pay us a cent until you receive your funds from the IRS. Our fee includes preparation of your claim by a series of expert CPAs and Tax Attorneys, in addition to some of the strongest client protections in the industry. With a fee structure of either 25% fully deferred or 18% upfront, we are an industry leader in the value we provide our clients.

Absolutely! Our professional team of Account Executives and CPAs are equipped and ready to help as many businesses as possible to apply for their ERTC funds. We welcome you to share this site and information with your colleagues.

BEST IN THE BUSINESS

We Keep it Simple

Let our client portal take you through the submission process at your own pace. You'll have a dedicated specialist standing by to help every step of the way.

We Follow the Rules

The tax code might be complex, but the rules are straightforward. Since our license is connected to every filing, complying with all IRS regulations is our top priority.

We Maximize Your Refund

We know exactly what we’re looking for. Our team has maintained a 100% success rate while filing for over 19,000 businesses.

ERTC Express, LLC

Tampa, FL 33609

Copyright 2024